On this page

What's next

Earn a high-yield savings rate with JG Wentworth Debt Relief

What are the Legal Risks of Being in Debt?

by

JG Wentworth

•

May 16, 2023

•

6 min

The information on this blog is provided for educational and informational purposes only. Such information or materials do not constitute and are not intended to provide legal, accounting, or tax advice and should not be relied on in that respect. We suggest that You consult an attorney, accountant, and/or financial advisor to answer any financial or legal questions.

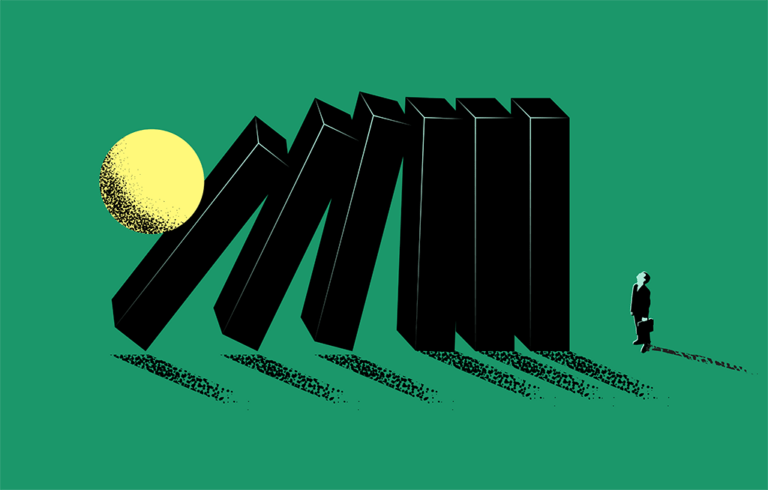

In many ways, financial stability is a lot like being in good health. It isn’t until we fall out of those categories that we truly appreciate how much simpler life can be without medical or financial challenges.

Health issues often carry complications with them such as daily medicine, strict diets and the stress of monitoring blood pressure, blood sugar levels or any number of other things that many of us never need to think about. Similarly, financial issues like debt lead to plenty of complications that the debt-free world is never faced with – especially when it comes to legal issues.

Debt Collection

When you owe money to a lender, they have the right to try and collect the debt from you. Depending on the lender’s policies, this could happen via email, snail mail, phone calls, or even in-person inquiries. These intrusions can be stressful reminder that you are in legal hot water that will likely get increasingly hotter as more time passes.

By the way, you should always keep in mind that debt collectors are not allowed to use abusive, unfair, or deceptive practices to collect your money. This includes calling you repeatedly, using obscene language, or threatening you with legal action. If you are experiencing debt collection harassment, you have the right to file a complaint with the Consumer Financial Protection Bureau (CFPB) and take legal action against the collector.

Wage Garnishment

If you are unable to pay your debts in a timely fashion, your creditors may have the legal right to collect the money they are owed from your wages. In other words, they can take money directly from your paycheck until the debt is paid off. For most of us, having a significant portion of your earnings taken out with no say in the matter is a tough pill to swallow.

Unfortunately, this practice is 100% legal in many states. If you are in debt, it is strongly suggested that you check your state’s relevant laws and find out if your creditors might be preparing to put their hands into your pockets.

Legal Action

Even if you consider the above solutions “reasonable,” the next one takes things to the next level. If you fail to pay your debts and there is no way for your creditor to work with you to get them, they may be forced to take legal action against you. If forced, they may opt to obtain a judgment against you, or even seize your assets to pay off your balances. While legal action is typically a last resort for creditors, it is a dangerous possibility for borrowers who are otherwise unable to pay their debts.

"*" indicates required fields

Credit Score Damage

Most of us aren’t financial experts, and very few of us know exactly how various factors can affect your credit score. What we do know is that struggling with debt will almost definitely cause some sort of damage.

Overdue payments, defaults, and collections can all hurt your credit score, making it harder to borrow money, rent an apartment, get a job, or qualify for insurance. It can also prevent you from getting lower interest rates on mortgages, car loans and other major purchases, costing you even more money in the future.

Keep in mind that all the horrific situations explained above happen every day to those in debt. At JG Wentworth, we specialize in providing solutions for folks with financial challenges, so give us a call at (phone number) and let’s discuss how our Debt Resolution Program may be the perfect way to save you from a similar fate.

How to Protect Yourself from Legal Risks of Debt

The best way to protect yourself from the legal hassles of being in debt is to keep yourself out of debt. We know this sounds a lot easier than it is but staying ahead of your financial peaks and valleys can go a long way in keeping your head above water. Do everything you can to pay your bills on time, or, if necessary, let your lenders know if you are having financial difficulties. Don’t be afraid to seek professional help if you need it.

If you are in the position of being potentially targeted by creditors, you should get familiar with your rights under the Fair Debt Collection Practices Act (FDCPA) and the Consumer Credit Protection Act (CCPA). These laws provide protection for consumers against debt collection harassment, wage garnishment and other aggressive tactics that creditors might resort to while on their mission to collect the funds they are owed.

About the author

Recommended reading for you

* This is a Debt resolution program provided by JGW Debt Settlement, LLC (“JGW” of “Us”)). JGW offers this program in the following states: AL, AK, AZ, AR, CA, CO, FL, ID, IN, IA, KY, LA, MD, MA, MI, MS, MO, MT, NE, NM, NV, NY, NC, OK, PA, SD, TN, TX, UT, VA, DC, and WI. If a consumer residing in CT, GA, HI, IL, KS, ME, NH, NJ, OH, RI, SC and VT contacts Us we may connect them with a law firm that provides debt resolution services in their state. JGW is licensed/registered to provide debt resolution services in states where licensing/registration is required.

** Program length varies depending on individual situation. Programs are between 24 and 60 months in length. Clients who are able to stay with the program and get all their debt settled realize approximate savings of 43% before our 25% program fee.

Debt resolution program results will vary by individual situation. As such, debt resolution services are not appropriate for everyone. Not all debts are eligible for enrollment. Not all individuals who enroll complete our program for various reasons, including their ability to save sufficient funds. Savings resulting from successful negotiations may result in tax consequences, please consult with a tax professional regarding these consequences. The use of the debt settlement services and the failure to make payments to creditors: (1) Will likely adversely affect your creditworthiness (credit rating/credit score) and make it harder to obtain credit; (2) May result in your being subject to collections or being sued by creditors or debt collectors; and (3) May increase the amount of money you owe due to the accrual of fees and interest by creditors or debt collectors. Failure to pay your monthly bills in a timely manner will result in increased balances and will harm your credit rating. Not all creditors will agree to reduce principal balance, and they may pursue collection, including lawsuits. JGW’s fees are calculated based on a percentage of the debt enrolled in the program. Read and understand the program agreement prior to enrollment.

JG Wentworth does not pay or assume any debts or provide legal, financial, tax advice, or credit repair services. You should consult with independent professionals for such advice or services. Please consult with a bankruptcy attorney for information on bankruptcy.