On this page

What's next

Earn a high-yield savings rate with JG Wentworth Debt Relief

Bonds and consumer debt may seem like they belong to separate financial worlds—one the domain of sophisticated investors and governments, the other the everyday reality of mortgage payments and credit card bills. Yet these two forms of debt are fundamentally connected, linked by the same economic principles and often directly influencing each other in ways that impact the financial well-being of ordinary people.

Let’s take a closer look at what bonds are, how they function as debt instruments, and the often-overlooked connections between the bond market and the struggles of everyday consumers with debt. Understanding these relationships can provide valuable insight into the broader economic forces that shape personal financial circumstances.

What are bonds?

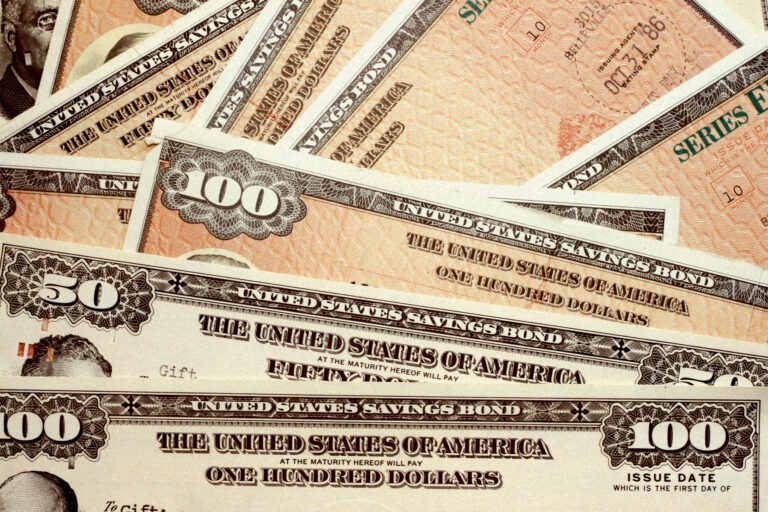

At their core, bonds are debt instruments. When an entity issues a bond, it is essentially borrowing money and promising to repay it with interest. The bond itself is a type of IOU—a legal document that outlines the terms of the loan, including:

- The principal amount (the sum being borrowed).

- The maturity date (when the principal must be repaid in full).

- The coupon rate (the interest rate the issuer will pay to the bondholder).

- The payment schedule (typically semi-annual interest payments).

Who issues bonds?

Bonds are issued by various entities:

- Governments: Federal, state, and local governments issue bonds to finance public projects, services, and operations. U.S. Treasury bonds, notes, and bills are considered among the safest investments in the world.

- Corporations: Companies issue corporate bonds to fund expansion, research, acquisitions, or other business activities.

- Financial institutions: Banks and other financial institutions may issue bonds to raise capital.

- International organizations: Entities like the World Bank issue bonds to fund global development projects.

Bonds as investment vehicles

From an investor’s perspective, bonds function as relatively stable investment vehicles. When you purchase a bond, you are lending money to the issuer in exchange for regular interest payments and the eventual return of your principal. Bonds are often considered less risky than stocks, though they typically offer lower returns over the long term.

The connection to consumer debt

While bonds themselves are primarily in the realm of institutional finance, they have significant connections to the debt carried by ordinary consumers. These connections operate through several channels:

Interest rate influence

Perhaps the most direct connection between bonds and consumer debt is through interest rates. Bond yields (the return an investor receives from a bond) significantly influence interest rates throughout the economy, including those on consumer loans.

Here’s how it works:

- The yields on U.S. Treasury bonds serve as a benchmark for many other interest rates.

- When Treasury yields rise, interest rates on mortgages, auto loans, personal loans, and credit cards typically follow suit.

- Conversely, falling bond yields often lead to lower consumer interest rates.

For consumers struggling with debt, a shift in bond yields can mean the difference between manageable payments and financial distress. For example, a homeowner with an adjustable-rate mortgage might see their monthly payment increase substantially if bond yields rise, potentially pushing them toward financial hardship.

Securitization: How consumer debt becomes bonds

In a process known as securitization, many consumer loans are packaged together and transformed into bond-like securities that can be bought and sold by investors. This creates a direct link between consumer debt and the bond market:

- Mortgage-backed securities (MBS): Pools of home mortgages packaged into securities and sold to investors.

- Asset-backed securities (ABS): Similar to MBS but based on auto loans, credit card debt, student loans, or other consumer debt.

- Collateralized debt obligations (CDOs): Complex securities that may include various types of debt, including consumer loans.

This securitization process was at the heart of the 2008 financial crisis, when mortgage-backed securities containing subprime loans failed en masse, demonstrating how problems in consumer debt can ripple through the financial system.

For consumers, securitization can influence:

- The availability of credit.

- The terms and interest rates offered.

- How flexible lenders might be during financial hardship.

Economic cycle effects

Bonds and consumer debt are both affected by—and contribute to—economic cycles:

- During economic downturns: Bond prices often rise as investors seek safety, potentially leading to lower interest rates that could benefit consumers looking to refinance debt.

- During economic expansion: Bond prices may fall (and yields rise) as investors move toward higher-risk investments, which can lead to higher consumer loan rates.

- Inflation concerns: Can lead to higher bond yields and subsequently higher consumer loan rates, increasing the burden on those already struggling with debt.

These economic cycles can significantly impact consumers’ ability to manage their debt, sometimes creating opportunities for refinancing and other times increasing financial pressure.

Credit rating parallels

Both bonds and consumer loans rely on credit rating systems to assess risk:

- Bonds are rated by agencies like Moody’s, S&P, and Fitch (AAA being the highest quality).

- Consumers are rated by credit bureaus using FICO scores and similar metrics.

These parallel systems determine:

- Who can borrow

- How much they can borrow

- At what interest rate they can borrow

For consumers with lower credit scores, the parallels to lower-rated “junk bonds” are clear: higher interest rates, stricter terms, and fewer options.

Take your next step towards being debt-free

"*" indicates required fields

How bond markets affect struggling consumers

For consumers already struggling with debt, the bond market can have several specific impacts: Refinancing opportunities When bond yields fall, interest rates on consumer loans typically decrease as well. This can create opportunities for refinancing:- Homeowners may be able to refinance mortgages at lower rates.

- Credit card balance transfers to lower-rate options might become available.

- Consolidation loans may offer more favorable terms.

- Higher mortgage rates make homes less affordable.

- Monthly payments increase for the same loan amount.

- Fewer people qualify for mortgages.

- Bond performance affects their retirement savings

- Lower yields may force near-retirees to take on more risk to generate needed income

- This can complicate debt management strategies in later life

- High government debt levels may eventually lead to reduced public services

- This can include cuts to programs that assist those in financial distress

- It may also lead to higher taxes, further pressuring indebted consumers

Financial strategies for consumers in a bond-influenced economy

Understanding the connection between bonds and consumer debt can help inform personal financial strategies: Monitor bond market trends While you don’t need to become a bond expert, being aware of major trends in the bond market can help you anticipate changes in consumer loan rates. Watch for news about:- Federal Reserve policy changes.

- Significant movements in Treasury yields.

- Inflation reports, which often impact bond yields.

- Consider refinancing loans when bond yields are falling or at historical lows.

- If planning a major purchase requiring financing, track bond yields to identify potentially advantageous timing.

- Consider a mix of fixed-rate and variable-rate loans based on bond market outlooks.

- Maintain awareness of how different types of debt might respond to changing economic conditions.

- Create a financial plan that accounts for potential interest rate increases.

- Consider refinancing to fixed rates when bond yields are low.

- Maintain an emergency fund to handle potential payment increases.

The bottom line

Bonds and consumer debt exist on a continuum within the same financial ecosystem. The debt instruments traded by governments and corporations operate on the same fundamental principles as the loans taken by ordinary consumers. Through interest rate mechanisms, securitization processes, economic cycles, and credit rating systems, what happens in the bond market inevitably affects the financial reality of consumers struggling with debt. By understanding these connections, consumers can make more informed decisions about managing their debt, potentially finding opportunities within bond market movements and preparing for challenges that might arise from changes in this seemingly distant corner of the financial world.There’s always JG Wentworth…

If you have $10,000 or more in unsecured debt there’s a good chance you’ll qualify for the JG Wentworth Debt Relief Program.* Some of our program perks include:- One monthly program payment

- We negotiate on your behalf

- Average debt resolution in as little as 48-60 months

- We only get paid when we settle your debt

About the author

Recommended reading for you

* Program length varies depending on individual situation. Programs are between 24 and 60 months in length. Clients who are able to stay with the program and get all their debt settled realize approximate savings of 43% before our 25% program fee. This is a Debt resolution program provided by JGW Debt Settlement, LLC (“JGW” of “Us”)). JGW offers this program in the following states: AL, AK, AZ, AR, CA, CO, FL, ID, IN, IA, KY, LA, MD, MA, MI, MS, MO, MT, NE, NM, NV, NY, NC, OK, PA, SD, TN, TX, UT, VA, DC, and WI. If a consumer residing in CT, GA, HI, IL, KS, ME, NH, NJ, OH, RI, SC and VT contacts Us we may connect them with a law firm that provides debt resolution services in their state. JGW is licensed/registered to provide debt resolution services in states where licensing/registration is required.

Debt resolution program results will vary by individual situation. As such, debt resolution services are not appropriate for everyone. Not all debts are eligible for enrollment. Not all individuals who enroll complete our program for various reasons, including their ability to save sufficient funds. Savings resulting from successful negotiations may result in tax consequences, please consult with a tax professional regarding these consequences. The use of the debt settlement services and the failure to make payments to creditors: (1) Will likely adversely affect your creditworthiness (credit rating/credit score) and make it harder to obtain credit; (2) May result in your being subject to collections or being sued by creditors or debt collectors; and (3) May increase the amount of money you owe due to the accrual of fees and interest by creditors or debt collectors. Failure to pay your monthly bills in a timely manner will result in increased balances and will harm your credit rating. Not all creditors will agree to reduce principal balance, and they may pursue collection, including lawsuits. JGW’s fees are calculated based on a percentage of the debt enrolled in the program. Read and understand the program agreement prior to enrollment.

This information is provided for educational and informational purposes only. Such information or materials do not constitute and are not intended to provide legal, accounting, or tax advice and should not be relied on in that respect. We suggest that you consult an attorney, accountant, and/or financial advisor to answer any financial or legal questions.